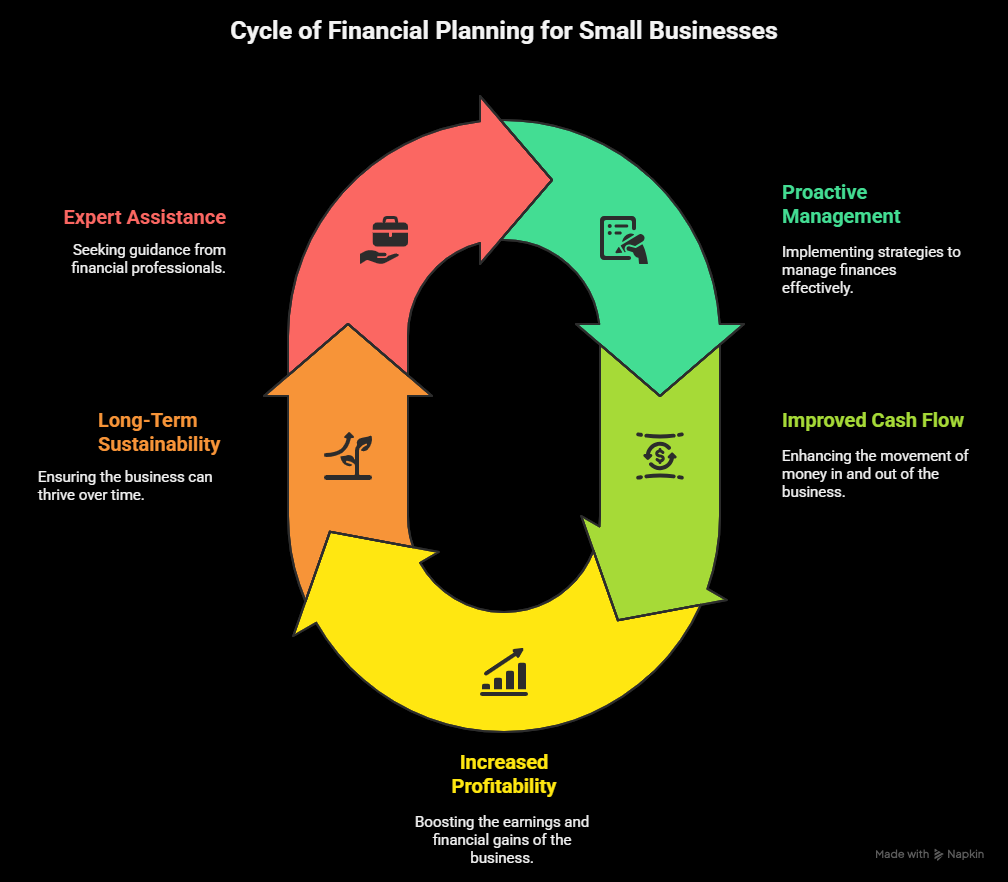

This document explores the critical importance of financial planning for small businesses. It highlights the benefits of proactive financial management, including improved cash flow, profitability, and long-term sustainability. Furthermore, it discusses how financial experts can provide invaluable assistance in developing and implementing effective financial strategies, ultimately increasing the likelihood of success for small business owners.

The Indispensable Role of Financial Planning for Small Businesses

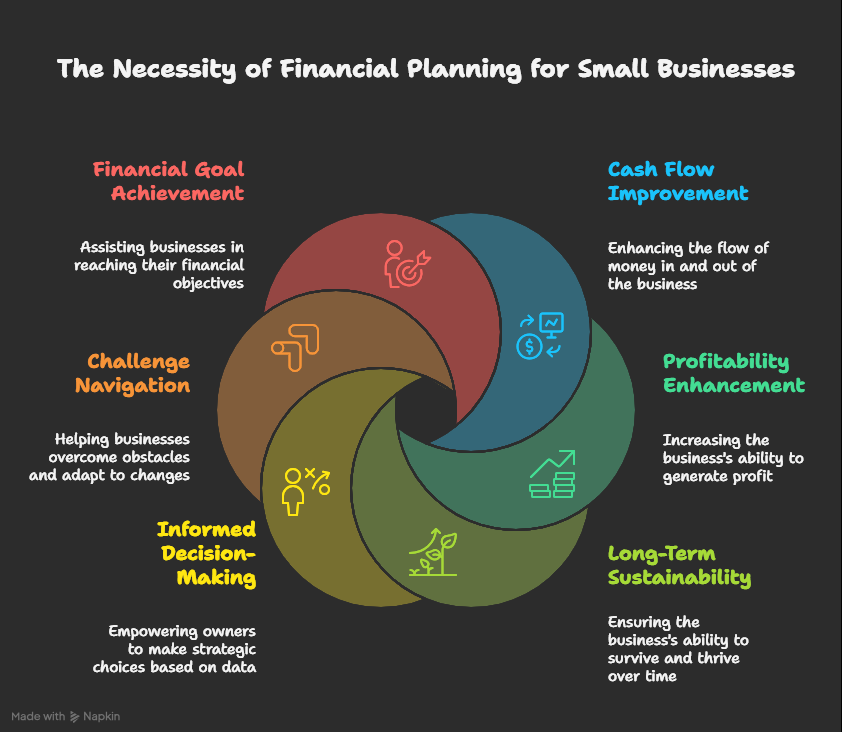

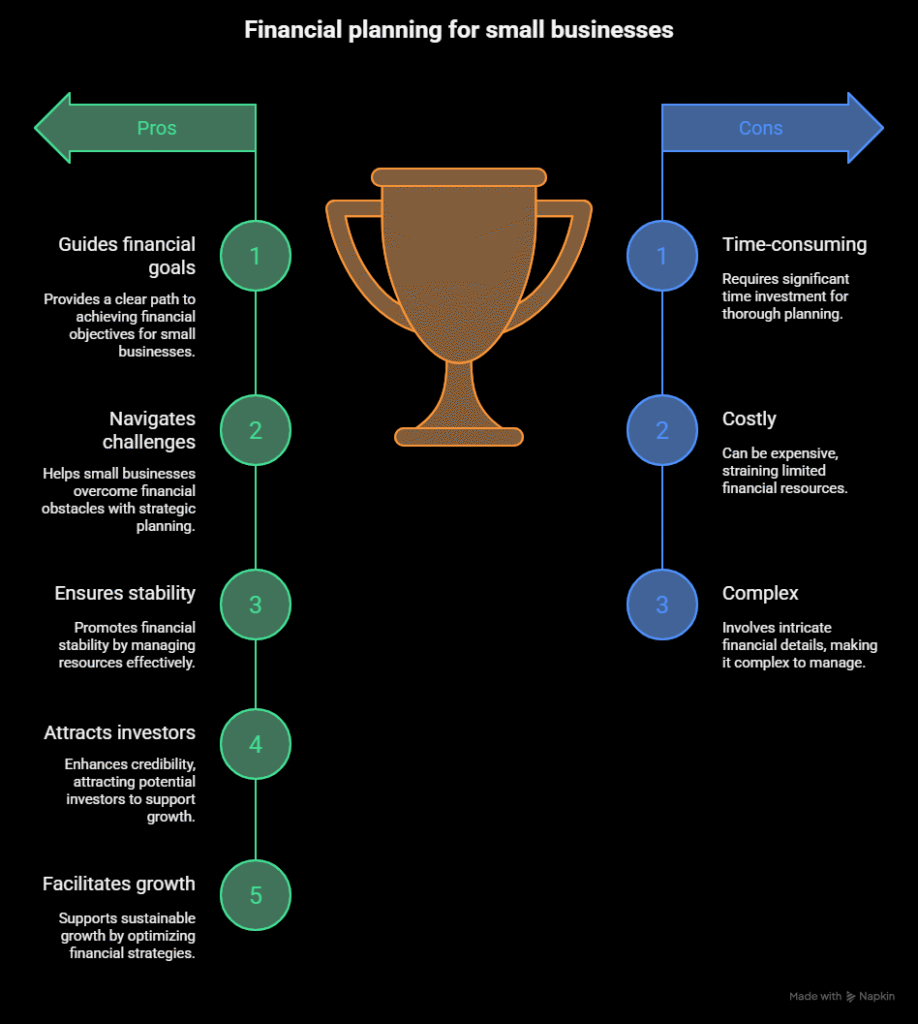

Financial planning is the cornerstone of any successful business, regardless of size. However, it’s particularly crucial for small businesses, which often operate with limited resources and face a higher risk of failure. A well-defined financial plan acts as a roadmap, guiding business owners toward their financial goals and helping them navigate the inevitable challenges that arise

Key Benefits of Financial Planning

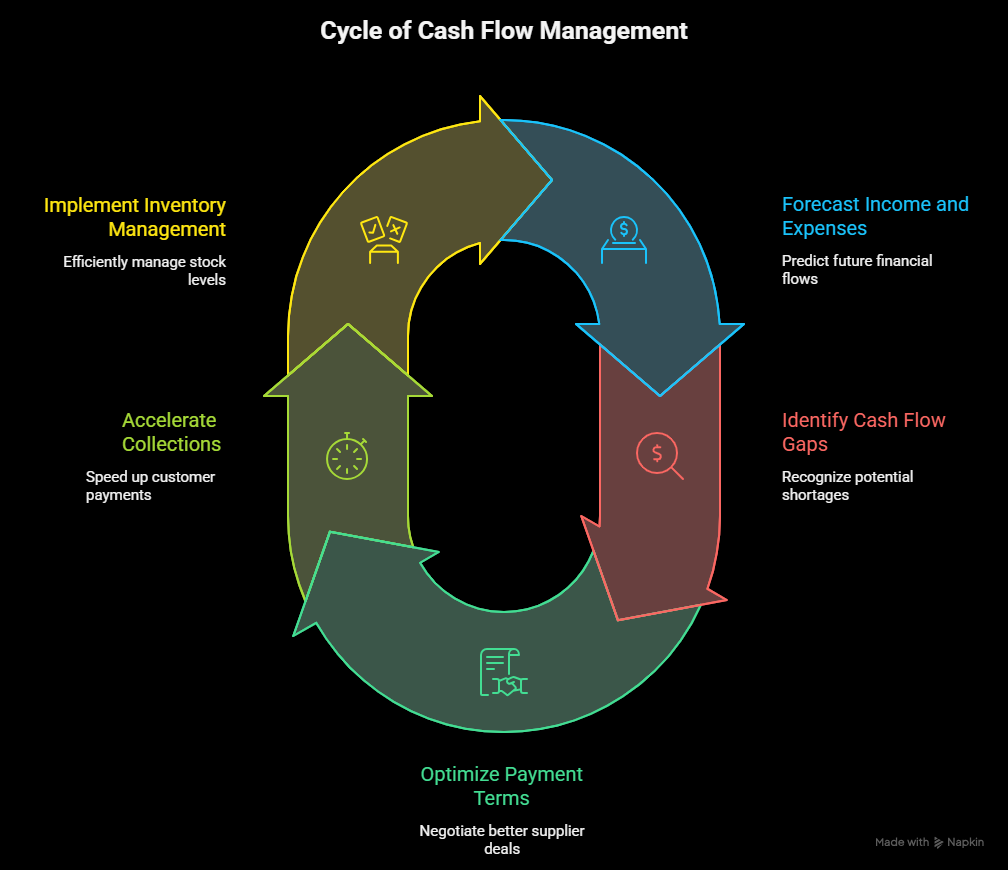

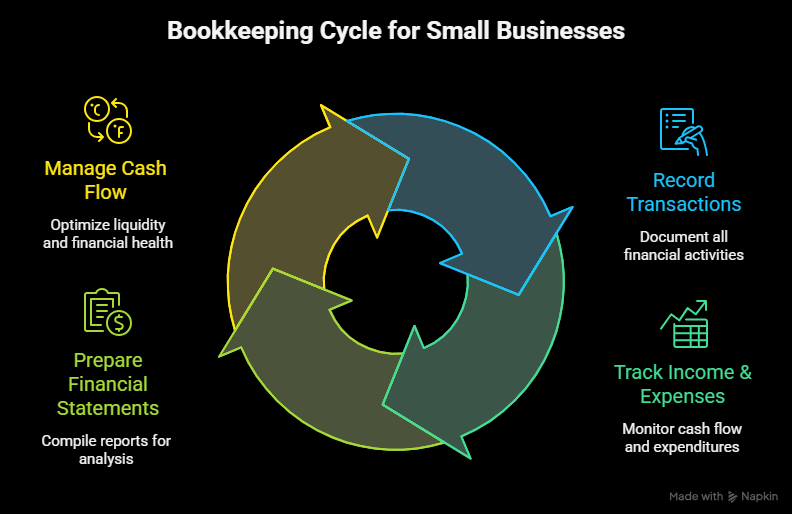

Improved Cash Flow Management: Cash flow is the lifeblood of any business. Financial planning helps small businesses forecast their income and expenses, identify potential cash flow gaps, and develop strategies to manage their working capital effectively. This includes optimizing payment terms with suppliers, accelerating collections from customers, and implementing efficient inventory management practices.

Enhanced Profitability: Financial planning enables businesses to analyze their revenue streams, identify cost-saving opportunities, and make informed pricing decisions. By understanding their profit margins and cost structure, small businesses can optimize their operations and improve their overall profitability.

Informed Decision-Making: A solid financial plan provides a framework for making sound business decisions. Whether it’s investing in new equipment, expanding into new markets, or hiring additional staff, financial planning helps business owners assess the potential risks and rewards of each decision and make choices that align with their long-term goals.

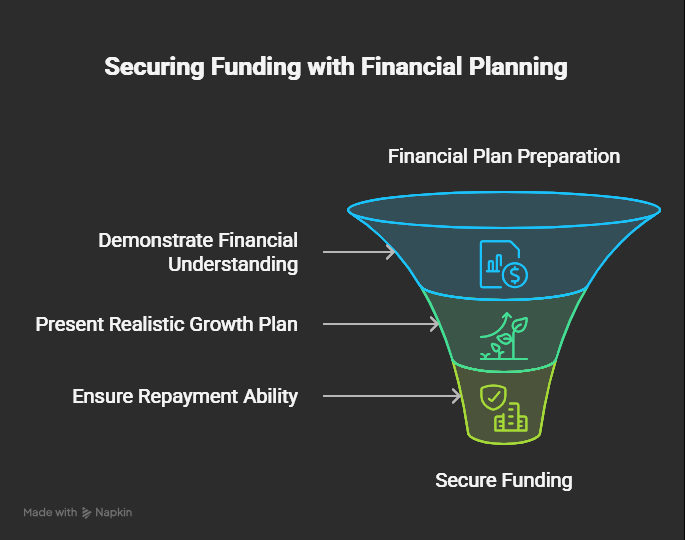

Access to Funding: When seeking funding from lenders or investors, a well-prepared financial plan is essential. It demonstrates that the business owner has a clear understanding of their financial situation, a realistic plan for growth, and the ability to repay their obligations.

Long-Term Sustainability: Financial planning is not just about short-term gains; it’s about building a sustainable business for the future. By anticipating potential challenges, such as economic downturns or changes in market conditions, small businesses can develop contingency plans and ensure their long-term viability.

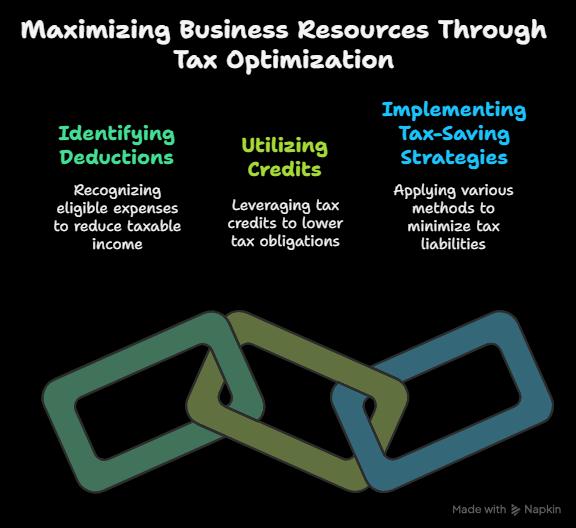

Tax Optimization: Financial planning can help small businesses minimize their tax liabilities by identifying eligible deductions, credits, and other tax-saving strategies. This can free up valuable resources that can be reinvested in the business.

The Value of Expert Assistance

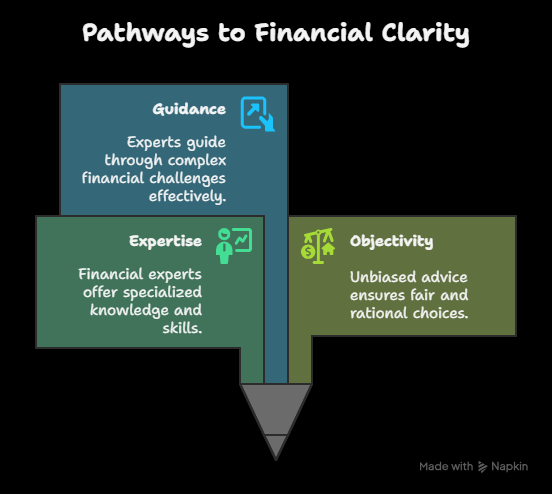

While some small business owners may attempt to handle their financial planning on their own, engaging a financial expert can provide significant advantages. Financial experts possess the knowledge, skills, and experience to develop and implement effective financial strategies tailored to the specific needs of each business.

How Financial Experts Can Help

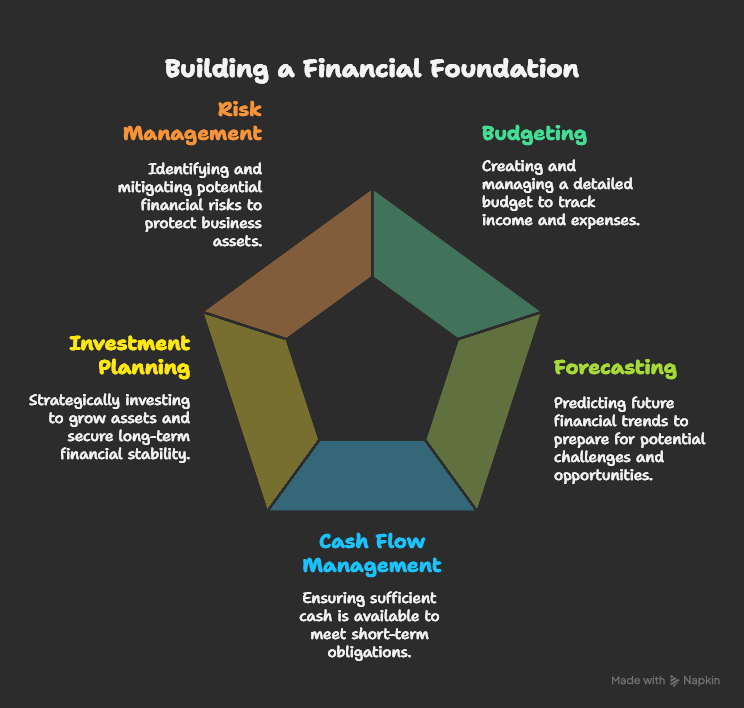

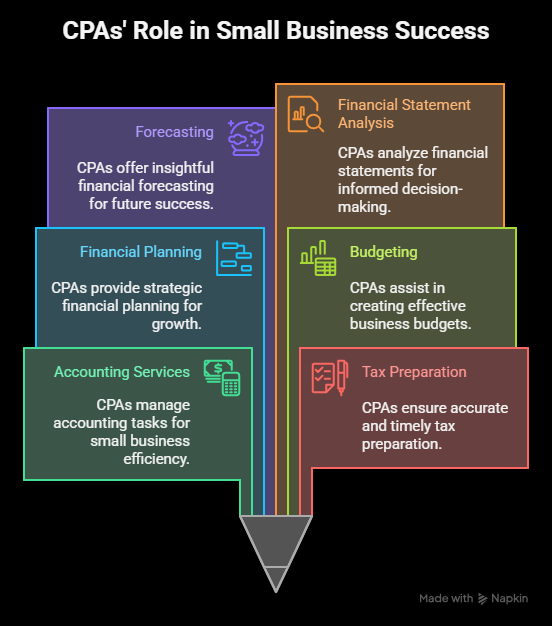

Developing a Comprehensive Financial Plan: Financial experts can work with small business owners to create a comprehensive financial plan that encompasses all aspects of their business, including budgeting, forecasting, cash flow management, investment planning, and risk management.

Providing Objective Advice: Financial experts can provide objective advice and guidance, free from emotional biases or personal agendas. This can be particularly valuable when making difficult decisions or navigating complex financial issues.

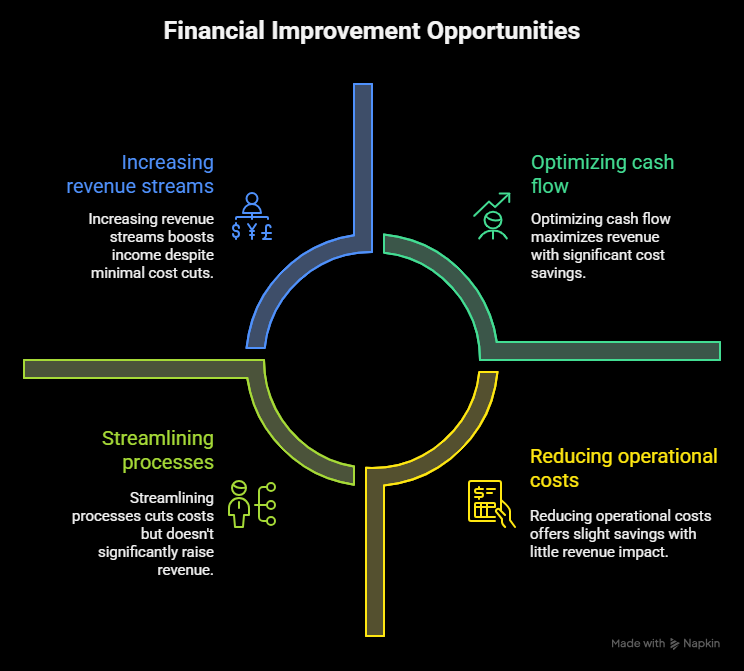

Identifying Opportunities for Improvement: Financial experts can analyze a business’s financial performance and identify opportunities for improvement, such as reducing costs, increasing revenue, or optimizing cash flow.

Navigating Complex Regulations: The financial landscape is constantly evolving, with new regulations and compliance requirements emerging regularly. Financial experts can help small businesses stay up-to-date on these changes and ensure that they are in compliance with all applicable laws and regulations.

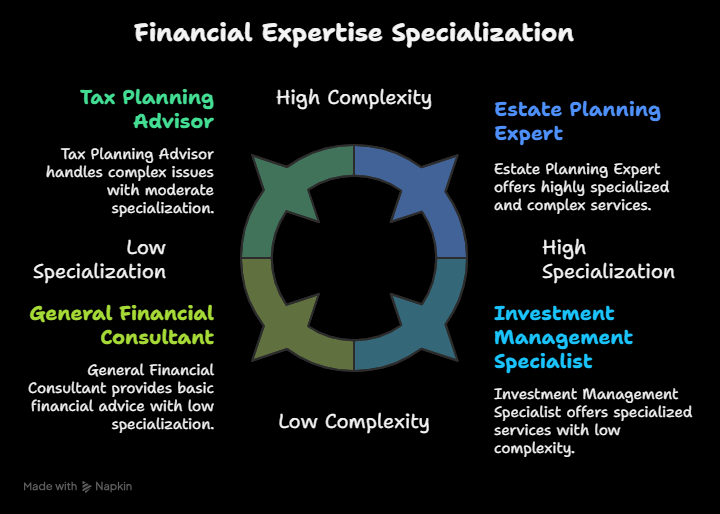

Accessing Specialized Expertise: Financial experts often have specialized expertise in areas such as tax planning, investment management, and estate planning. This can be invaluable for small business owners who need assistance with these complex issues.

Saving Time and Resources: By outsourcing their financial planning to an expert, small business owners can free up their time and resources to focus on other critical aspects of their business, such as sales, marketing, and operations.

Types of Financial Experts

Several types of financial experts can assist small businesses with their financial planning needs, including:

- Certified Public Accountants (CPAs): CPAs are licensed professionals who provide accounting, tax, and financial planning services. They can help small businesses with budgeting, forecasting, tax preparation, and financial statement analysis.

Financial Advisors: Financial advisors provide investment advice and financial planning services. They can help small businesses develop investment strategies, manage their retirement plans, and plan for the future.

Business Consultants: Business consultants provide a wide range of services, including financial planning, marketing, and operations management. They can help small businesses develop strategic plans, improve their efficiency, and increase their profitability.

Bookkeepers: Bookkeepers are responsible for recording financial transactions and maintaining accurate financial records. They can help small businesses track their income and expenses, prepare financial statements, and manage their cash flow.

Conclusion

Financial planning is not a luxury; it’s a necessity for small businesses that want to thrive in today’s competitive environment. By developing a comprehensive financial plan and seeking expert assistance, small business owners can improve their cash flow, profitability, and long-term sustainability. Investing in financial planning is an investment in the future of the business. It empowers owners to make informed decisions, navigate challenges effectively, and ultimately achieve their financial goals. The expertise of financial professionals can be the key to unlocking a small business’s full potential and ensuring its long-term success.